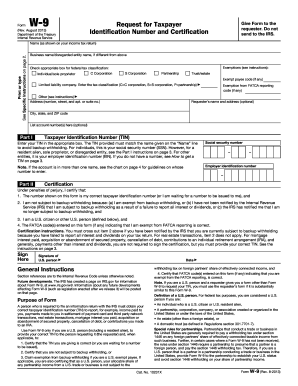

Who needs a form CMS-1-MN?

It’s a form to appeal an action, issued by the Department of Taxation and Finances. It was designed for all taxpayers in the State of New York. It can be filled out by the taxpayer himself, or by his representative, such as an attorney, spouse, child, or guardian.

What is form CMS-1-MN for?

With this form you can request a conciliation conference, tax appeals hearing, court review or small claim option. In all cases, an unbiased third party will decide if the prior action in the taxpayer’s case was reasonable and by virtue of law.

Is it accompanied by other forms?

It must be accompanied by a properly completed power of attorney (form POA-1), or with a copy, if one was already filed.

When is form CMS-1-MN due?

There are specific due dates to request any type of appeal. You should learn them from a tax office representative.

How do I fill out a form CMS-1-MN?

First, you have to write the name of a taxpayer, EIN or SSN, current address and telephone number. Then give all the same information about taxpayer’s representative. Determine the tax type involved and its period. Then check in the box to inform tax office what exactly is your request about. If you check “Redetermination of Deficiency”, don’t forget to attach a copy of notice you had previously received. If you request a refund, you need to write the date of first denial, attach a copy of notice (if any) and specify the amount you request. If license, permit, registration or exempt status is requested, write the date of notice and the type of document to be issued. Use blank space to provide your basis for this claim. In the end put down your signature and date of the request.

Where do I send it?

NYS Tax Department

BMS

W A Harriman Campus

Albany, NY 12227